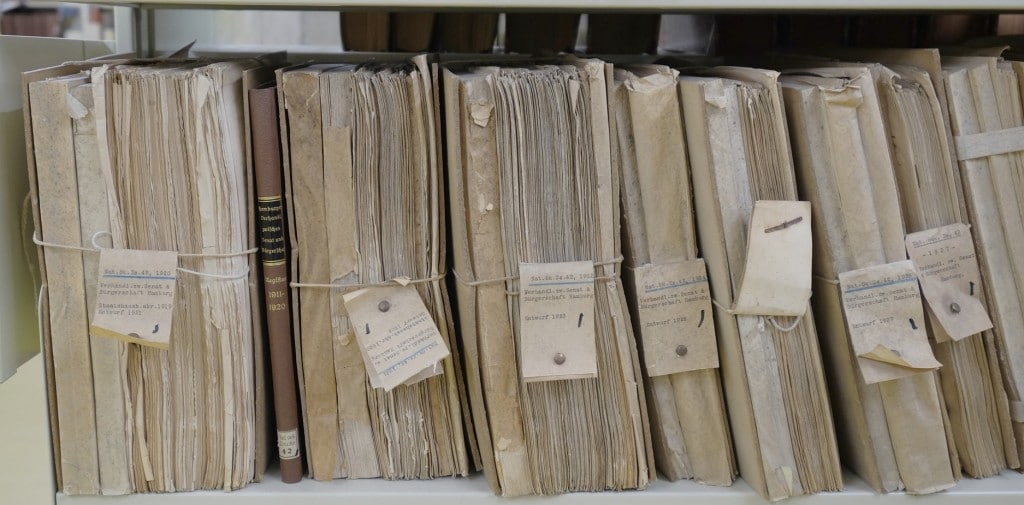

When you’re running a business it can sometimes feel like you’re drowning in paper. From company documents to order forms, invoices, receipts and important correspondence, the policy of ‘better safe than sorry’ for keeping documents can make for a messy, disorganised office. But how do you know what you need to keep hold of and what is safe to put through the shredder? Instead of hoarding everything for fear of throwing away something important, we want to show you what kinds of document you have to keep, what you can get rid of and when.

Keep For 6 Years

In order to be compliant with Government legislation there are certain documents that must be kept for 6 years from the date of the financial year they relate to. These are known as your accounting records. Your accounting records should be arranged by year and must include all money received and spent by the company, details of assets owned by the company and any debts the company owes or is owed. You should also keep a record of any stock the company owns at the end of each financial year and the stocktaking sheets used to work out that stock figure. Details of all goods bought and sold and who you bought them from and sold them to (unless you are running a retail business) are essential.

On top of the accounting records, you also need to keep any other financial records, information and calculations that you will need in order to prepare and file your annual tax returns. This will usually be covered by the above, but might also include receipts, petty cash books, delivery notes, copies of invoices, contracts and sales books. Documents produced relating to accounts, like balance sheets, profit and loss statements and financial forecasts should all be kept and stored securely.

To Be Kept Indefinitely

Amongst all of the day to day and yearly paperwork, there are a set of essential documents that should never be destroyed. For the most part this is the core information about your business and any changes that are made. You are required to keep detailed records about the company, including the details of directors, shareholders and company secretaries. The results of any shareholder votes, decisions and resolutions should be recorded, as well as promises for the company to repay loans at a specific date and who they are to be paid back to. You should also have documentation of any promises the company makes for payments if something goes wrong and the business is liable, any loans or mortgages secured against company assets and all records of transactions when someone buys or sells shares in the company. Because these documents don’t need to be accessed on a regular basis it is fairly common for businesses to keep them off site, or in secure locations, for example in a storage unit with other company records or stock. Bear in mind that if you do store your documentation anywhere but your companies registered address, you are required by law to inform companies house of where the documents are.

Keep Until Termination

There are certain documents that while you aren’t legally required to keep, you should hang on to. This covers things like contracts, agreements with suppliers or customers, service agreements or any other kind of binding contract. You may find yourself needing to reference these documents in the future, so you should keep a copy on hand until they reach their end dates. At that stage, you are free to shred the old documents and replace them with fresh agreements.

Safe To Shred

Unless the document shows proof of a deductible expense, experts say that things like receipts, deposit slips or monthly bank statements can be shredded on a monthly or annual basis. As long as your receipts have been reconciled with your bank statement or accounts and you have received your end of year bank statement, you don’t need to keep drawers full of receipts anymore.

Firmly in the ‘to shred’ pile is any document that does not directly relate to the company information or accounts and does not need to be kept for any other reason. Estimates, notes made in meetings, PDF’s printed of for group review and many other miscellaneous documents can be destroyed as soon as they are used in order to improve security and data protection policy.

If you aren’t sure about whether a document belongs in the ‘shred’ or ‘keep’ pile, think about how it relates to the business and how necessary it might be in the future. If it is a paper invoice you have an electronic copy of, you are probably safe to shred it. If you have a receipt from a customer meeting, you might need to submit it to accounting, or upload a photo of it to your accounting software before you get rid of it. But if you have just bought shares in the business, you should be filing it away for the future. For more information or to find out about our business friendly shredding service, get in touch with the Hungry Shredder team today.